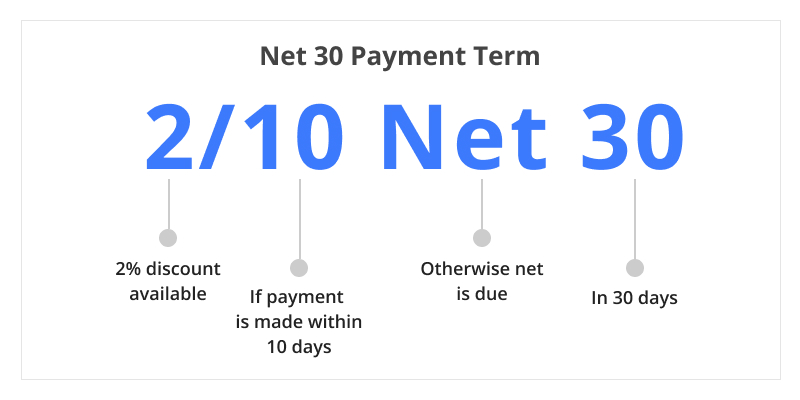

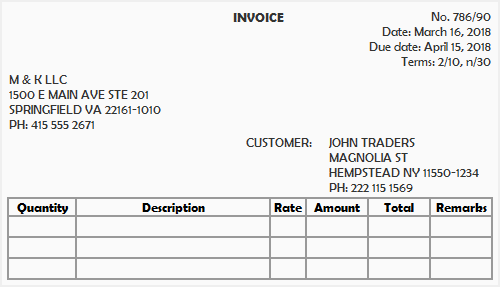

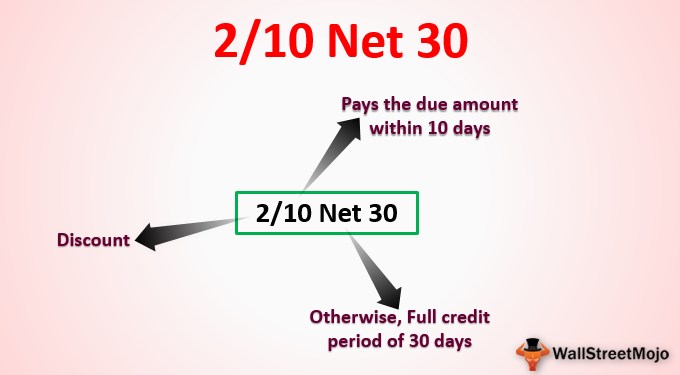

Jun 15, 15 · 2/10 or 1/10 n/30 are discounts that offer an incentive for a customer to pay for purchases in a timely manner A company offering terms of 2/10 is offering a discount of 2% provided that the invoice is paid within 10 days This amounts to aCh 5 8 examples to help out with the terms Learn with flashcards, games, and more — for free no adjusting journal entries need to be made for outstanding checks or deposits in transit for $1,000, terms 2/10, n/30 On June , SH returns to Oakley merchandise that SH had purchased for $300 On June 24, SH completely fulfills itsFor example, in the sale to the local business having a company picnic, Happy T's might have offered a 2% 10day, net 30 (2/10, n/30) discount This means that if the customer pays Happy T's within 10 days of the invoice date, they can take advantage of a 2% discount;

Solved Correct Way To Enter A Discount On A Vendor Bill

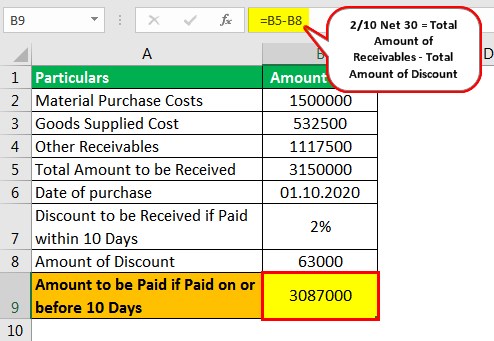

What does 2/10 n/30 mean in accounting

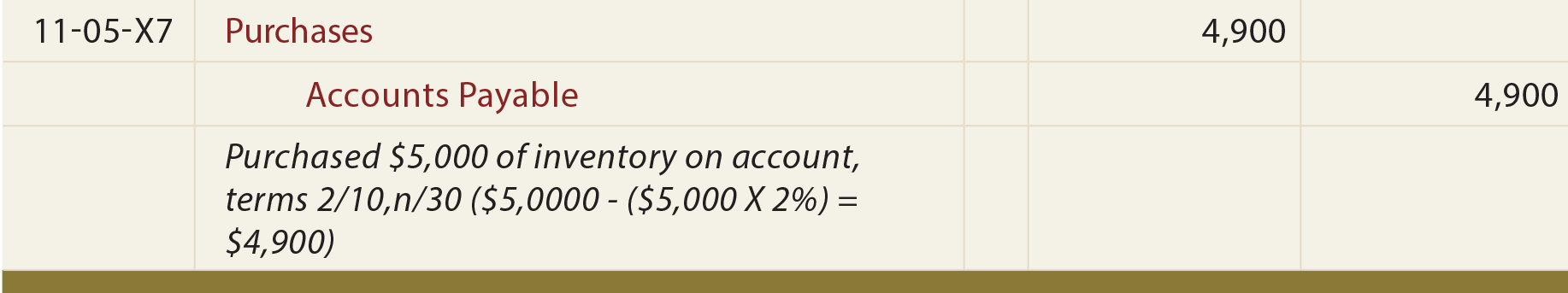

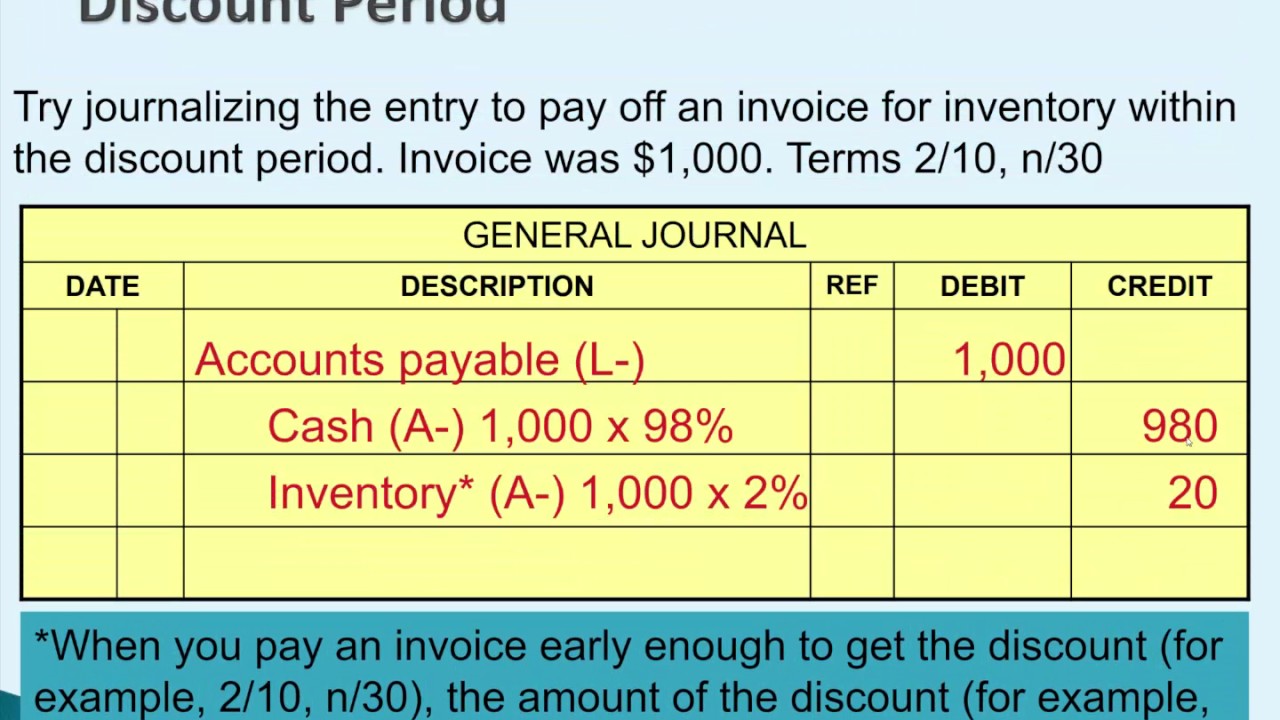

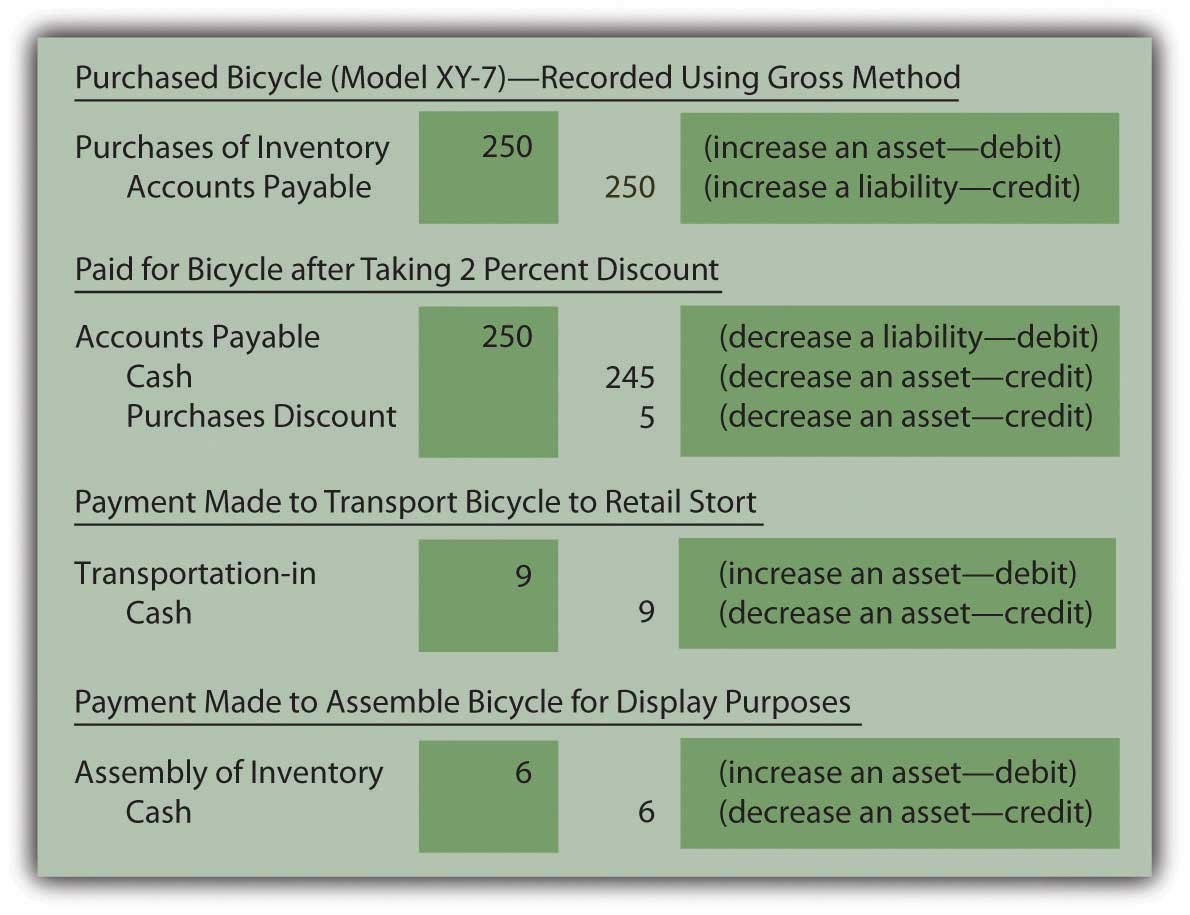

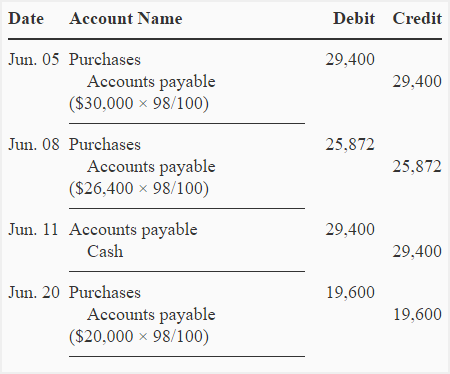

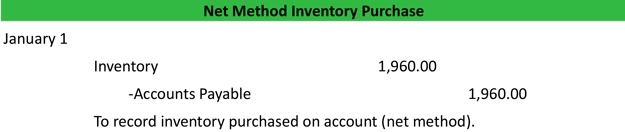

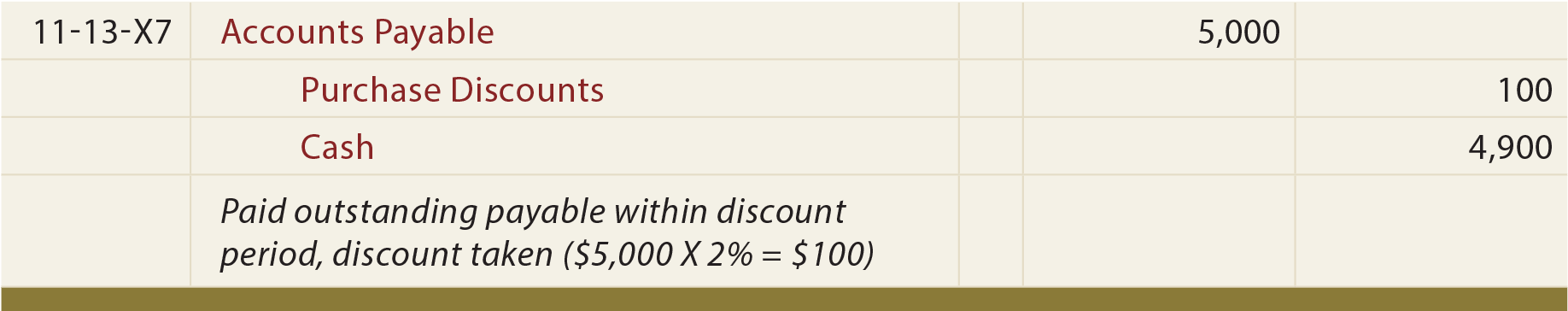

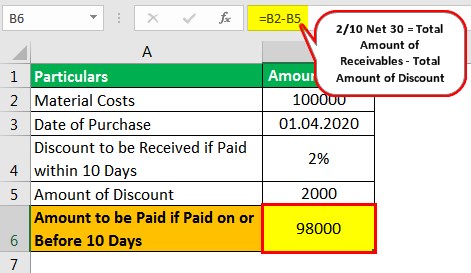

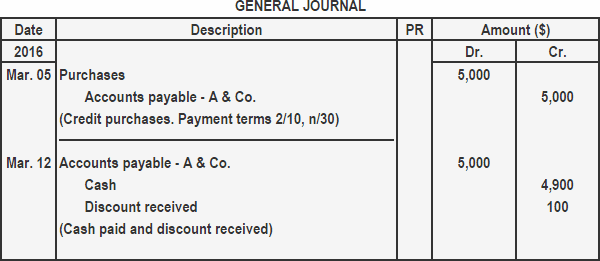

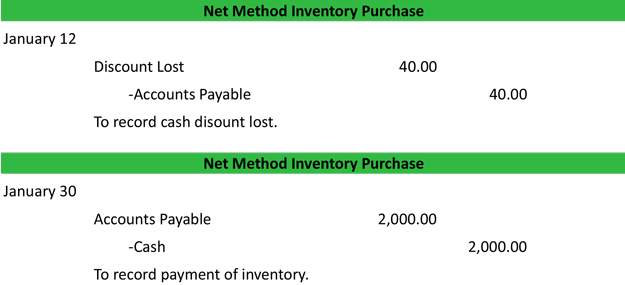

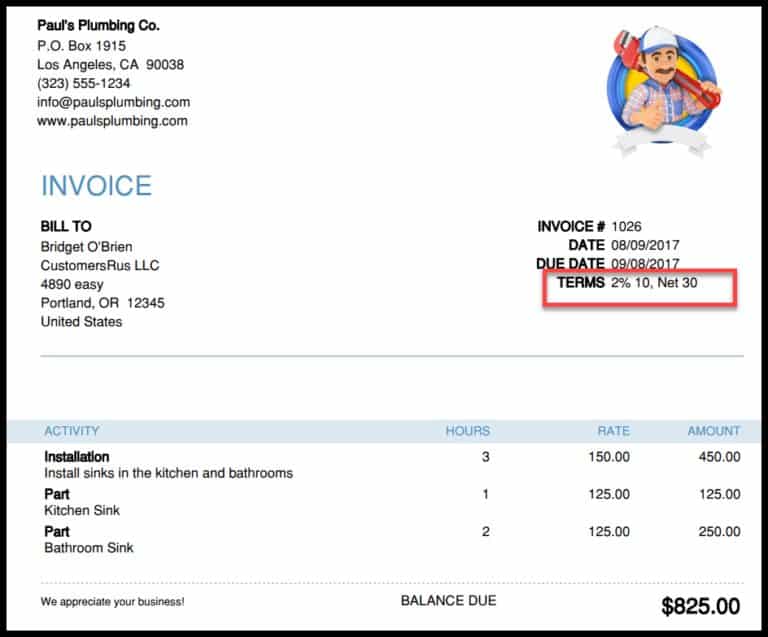

What does 2/10 n/30 mean in accounting-Mar 28, 16 · For example, the terms 2/10, n/30 means a 2% discount will be allowed if the payment is made within 10 days of the date of invoice, otherwise, the full amount is to be paid in 30 days Journal entry for cash discount Cash discount is an expense for seller and income for buyerThe most common discount term is 2/10, n/30 This means that if the vendor pays within 10 days of the invoice, it will get a 2 percent discount Otherwise, the net amount is due within 30 days The gross method assumes that the discount will not be taken and records the purchase without regard to the discount Let's take a look at an example

Solution When A Company Is Given Credit Accounting

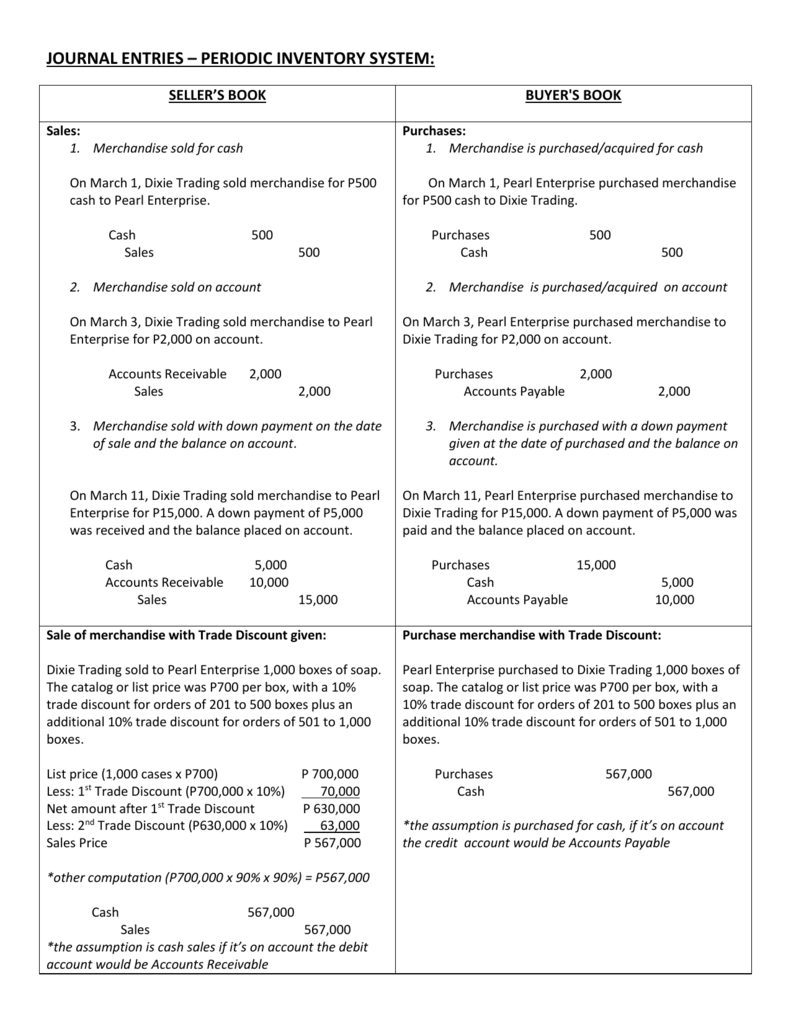

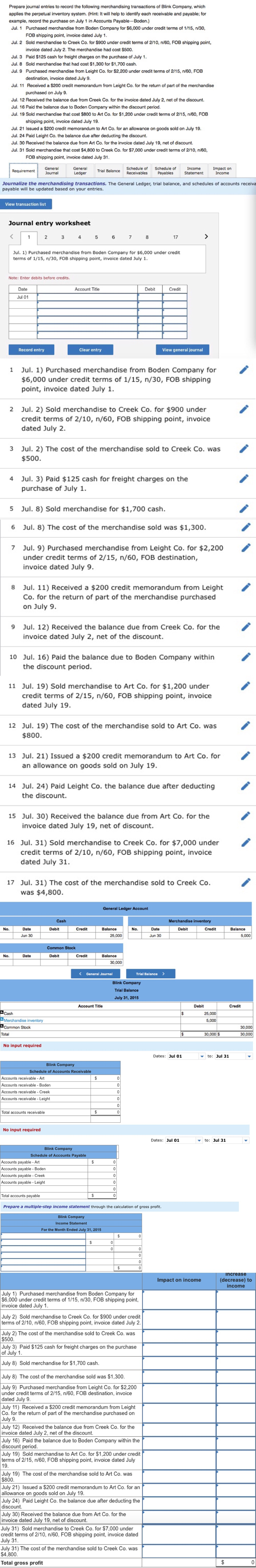

Example 1 S Company sold merchandise for cash to B Company worth P Journal from CEMA 123 at Laguna University Sta Cruz, LagunaNov 04, 18 · Journal Entry For example, assume that two $1,000 sales are made to different customers on May 10, ×1, under terms of "2/10, n/ 30" (which means that 2 percent can be deducted by the customer if they make payment withinThe journal entry to record a purchase allowance is the same as the entry to record a purchase return Assume that JCC discarded the 4 damaged books and received an allowance from the vendor The journal entry would be the same as the previous transaction as shown below Accounts PayableXYZ Pub 50

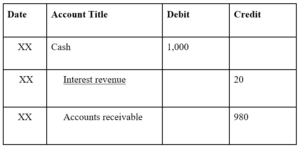

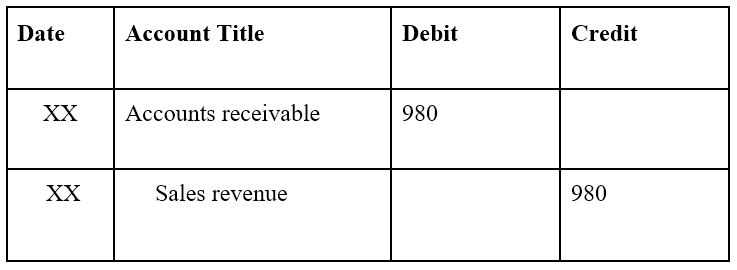

Question With Term 2/10, N/30 The Journal Entry To Record 12 Merchandise With A Sales Price O S500 Is Sold On Account The Sale Would Include A A Debit To Cash For $500 B Debit To Sales Discounts For $10 Or Credit To Sales For $500 Debit ToAccounting Journal Entry Examples More Examples of Journal Entries Accounting Equation Double Entry Recording of Accounting Transactions Debit Accounts Credit Accounts Asset Accounts Liability Accounts Equity Accounts Revenue Accounts Expense Accounts Accounting Cycle Journals and LedgersIV Journal Entry Types, Uses and Descriptions Journal entries (JEs) record financial transactions directly into the general ledger Generally, a JE should be completed when a correction, reclassification, accrual or transfer is needed in order to record an accounting transaction that accurately reflects the state's financial events

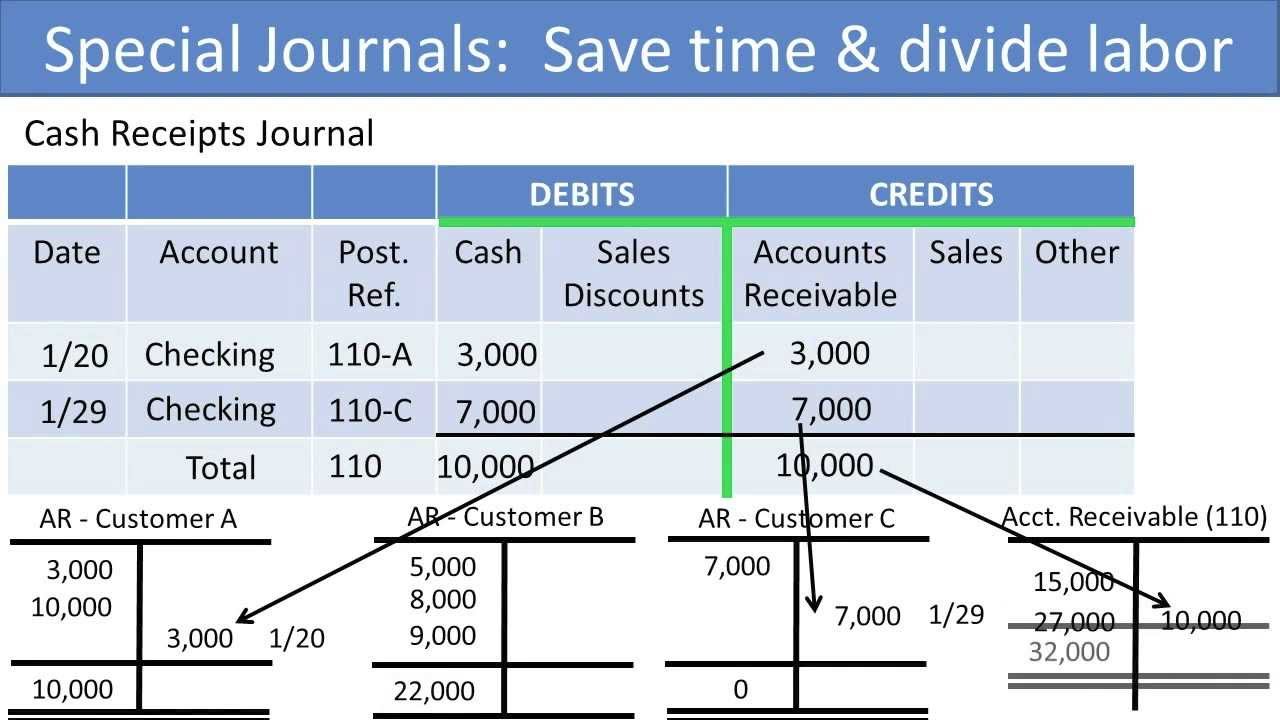

Otherwise, the full amount is due 30 days from the invoice dateCreate and Post Journal Entries with a Balancing Line When a journal contains multiple entries that are all applied to the same balancing account, one final balancing line can be entered so that only one complete line is posted to the balancing account This is beneficial, for example, in the Cash Receipt Journal to represent a deposit amountFor example, the terms 2/10, n/30 means a 2% discount will be allowed if the payment is made within 10 days of the date of invoice, otherwise, the full amount is to be paid in 30 days Journal entry

Solution When A Company Is Given Credit Accounting

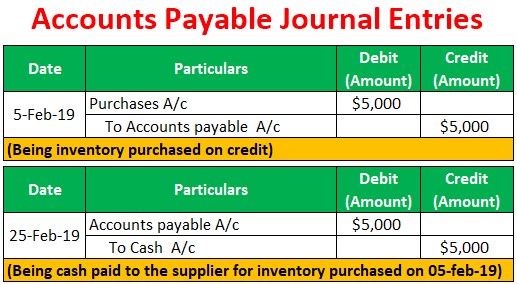

Accounts Payable Explanation Journal Entries Examples Accounting For Management

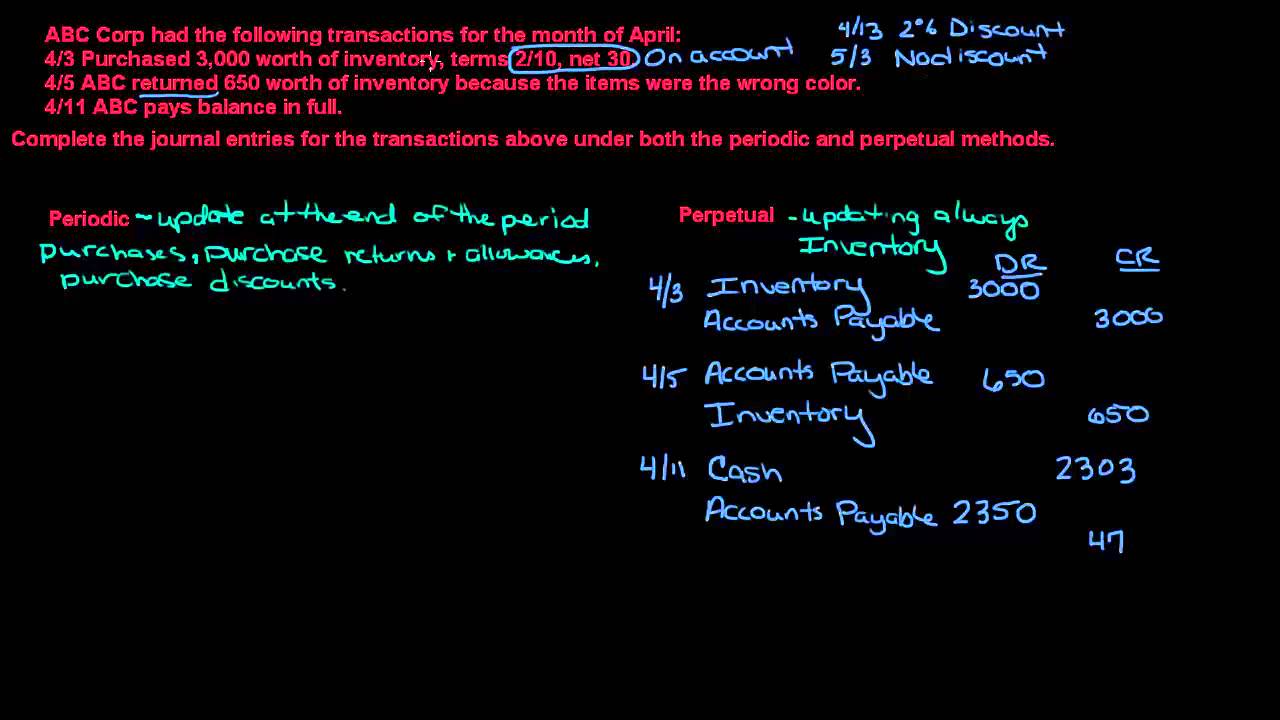

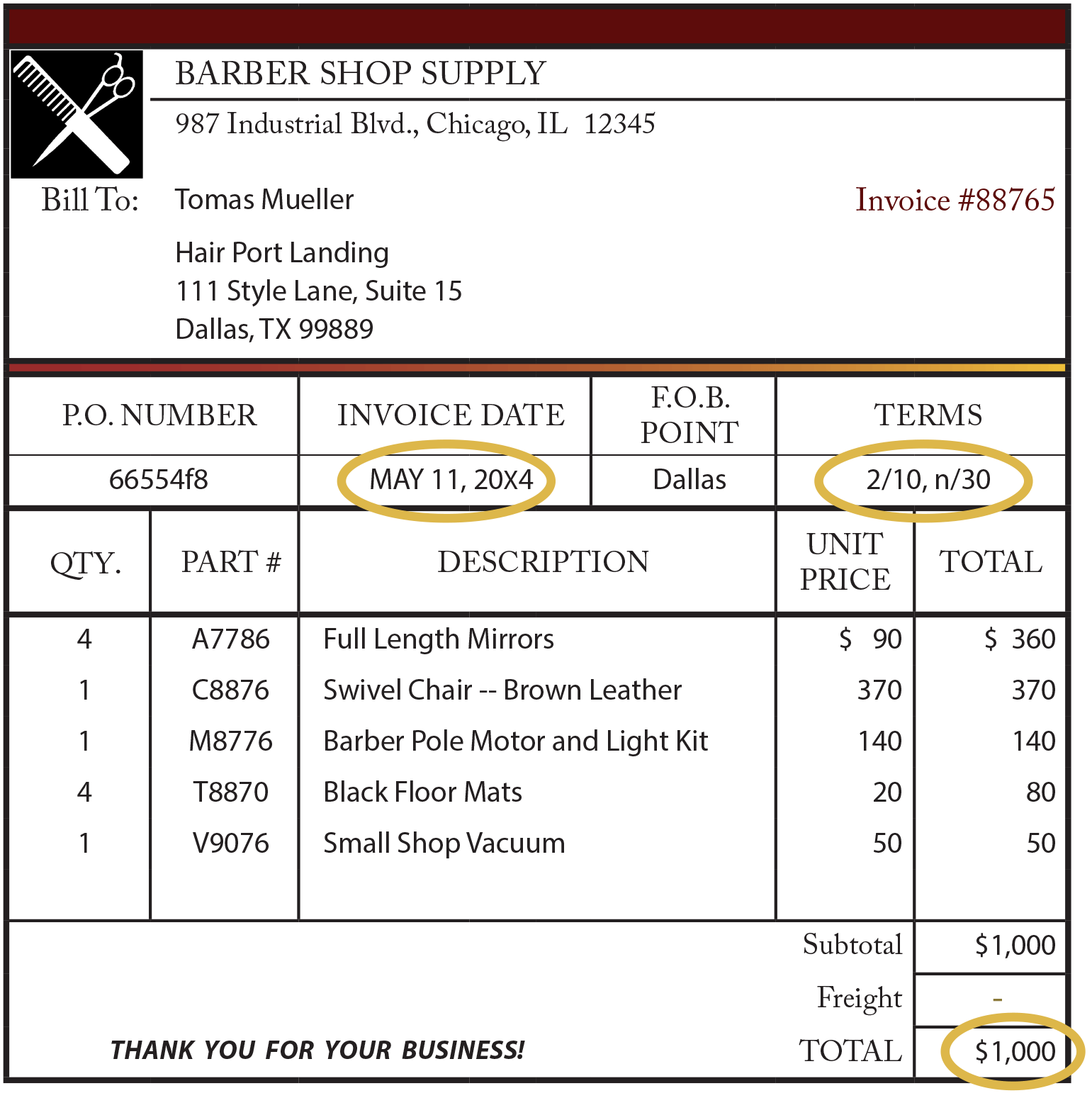

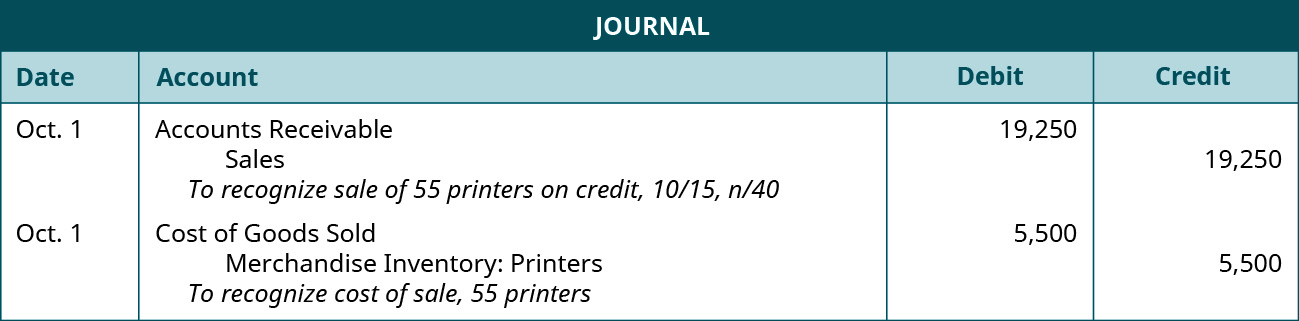

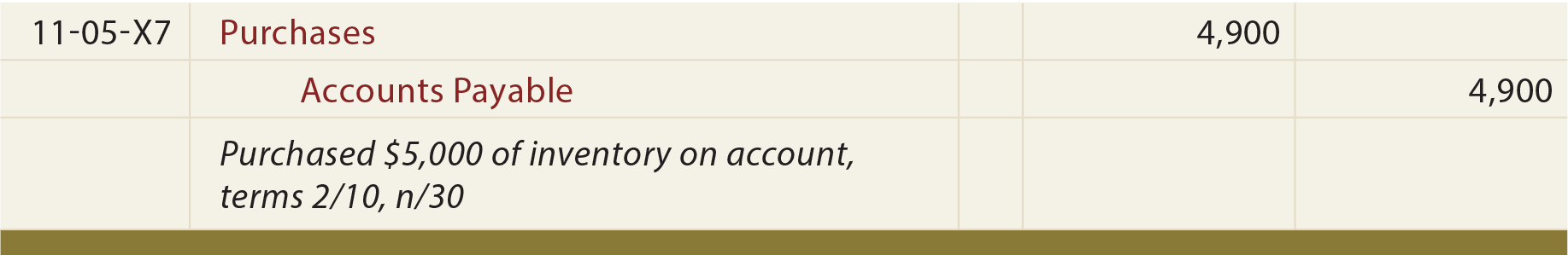

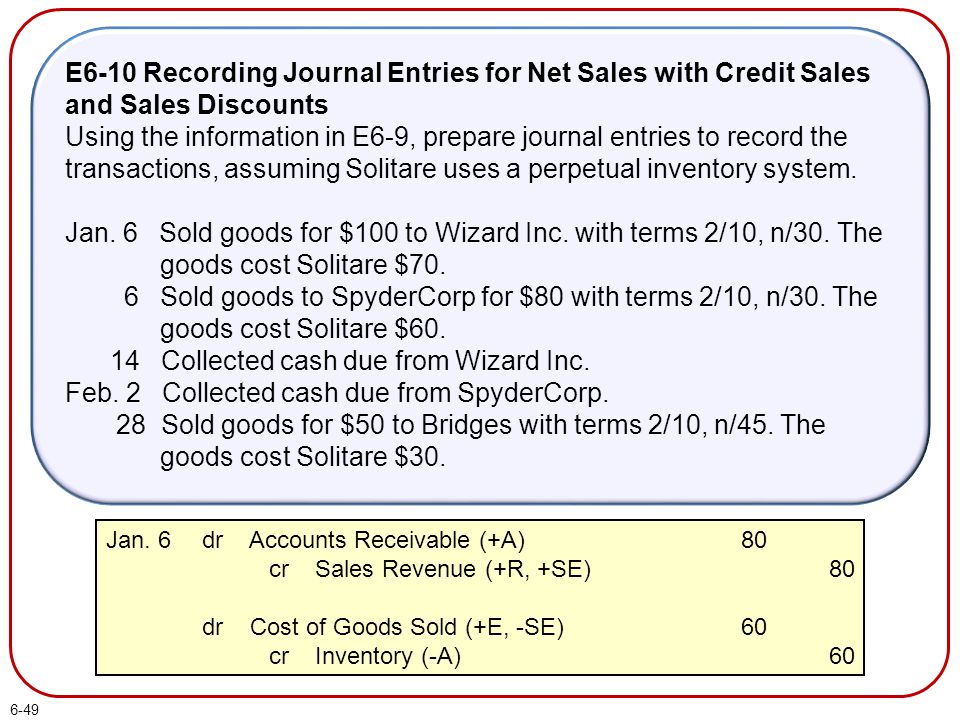

Recall from Merchandising Transactions, that credit terms of 2/10, n/30 signal the payment terms and discount, and FOB shipping point establishes the point of merchandise ownership, the responsibility during transit, and which entity pays shipping charges Therefore, 2/10, n/30 means Sierra Sports has ten days to pay its balance due to receiveDec 03, 19 · Net 30 terms or n/30 means that payment in full is due 30 days after the date of the invoice Net 30 terms are often combined with a cash discount for early settlement For example 2% 10 days, net 30 terms or 2/10, n/30 means, that a 2% discount can be taken if payment is made with 10 days, otherwise the full amount is due within 30 daysSales journal entry definition — AccountingTools COUPON (6 days ago) Dec 22, · credit Sales tax liability Same explanation as noted above Example of the Sales Journal Entry For example, a company completes a sale on credit for $1,000, with an associated 5% sales tax The goods sold have a cost of $650

2 10 N 30 Trade Discount Term Accounts Receivable Management In Urdu Hindi Youtube

Slides Show

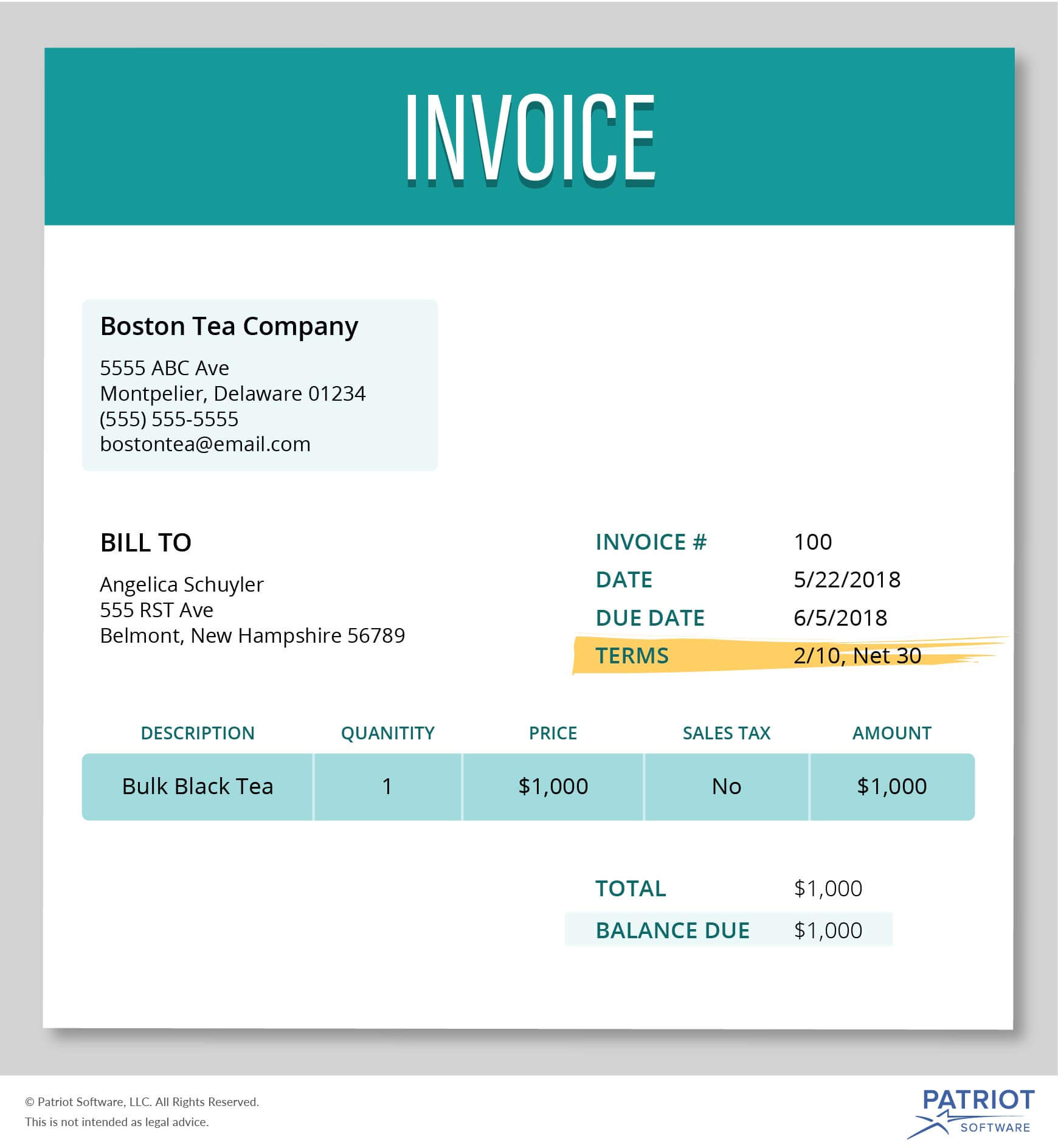

Let's see how the credit term of 2/10, n/30 works in an example Michael & Co Ltd ships $1,000 of goods to a customer If the customer pays Michael & Co Ltd within 10 days of the invoice date, the customer is allowed to deduct $ (2% of $1,000) from the purchase of $1,00003 Sold Goods to Wania for Rs 100,000 terms being 2/10 – n/30 And Sold Goods to Meerab for Rs 100,000 terms being 2/10 – n/30 And Cash Sales of Rs 100,000;Sep 28, 19 · or services 2/10 net 30 means that if the amount due is paid within 10 days, the customer will enjoy a 2% discount Otherwise, the amount is due in full within 30 days Example

Accounting For Merchandising Operations

Acg21 Connect Ch 4

May 12, · A sales journal entry records a cash or credit sale to a customer It does more than record the total money a business receives from the transaction Sales journal entries should also reflect changes to accounts such as Cost of Goods Sold ,Nov 11, 19 · For example, if a business sells goods to the value of 2,000 on 25/10, n/30 terms, it means that the full amount is due within 30 days but a 25% sales discount can be taken if payment is made within 10 days The sales discount in this example is calculated as follows Sales Discount Journal Entry0303 Bought Goods from Umair for Rs 100,000 terms being 5/10 – n/30

Credit Sales How To Record A Credit Sale With Credit Terms

Cash And Receivables Chapter 7 Intermediate Accounting 12

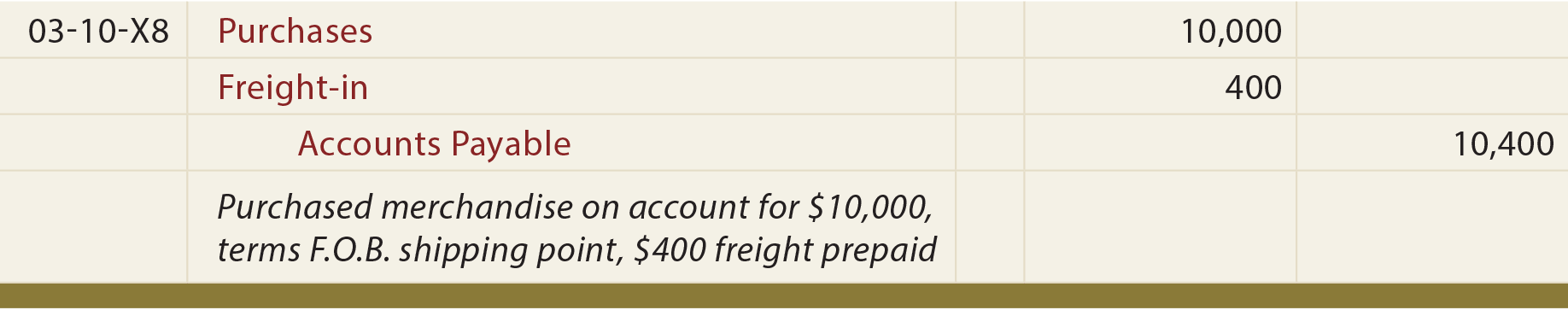

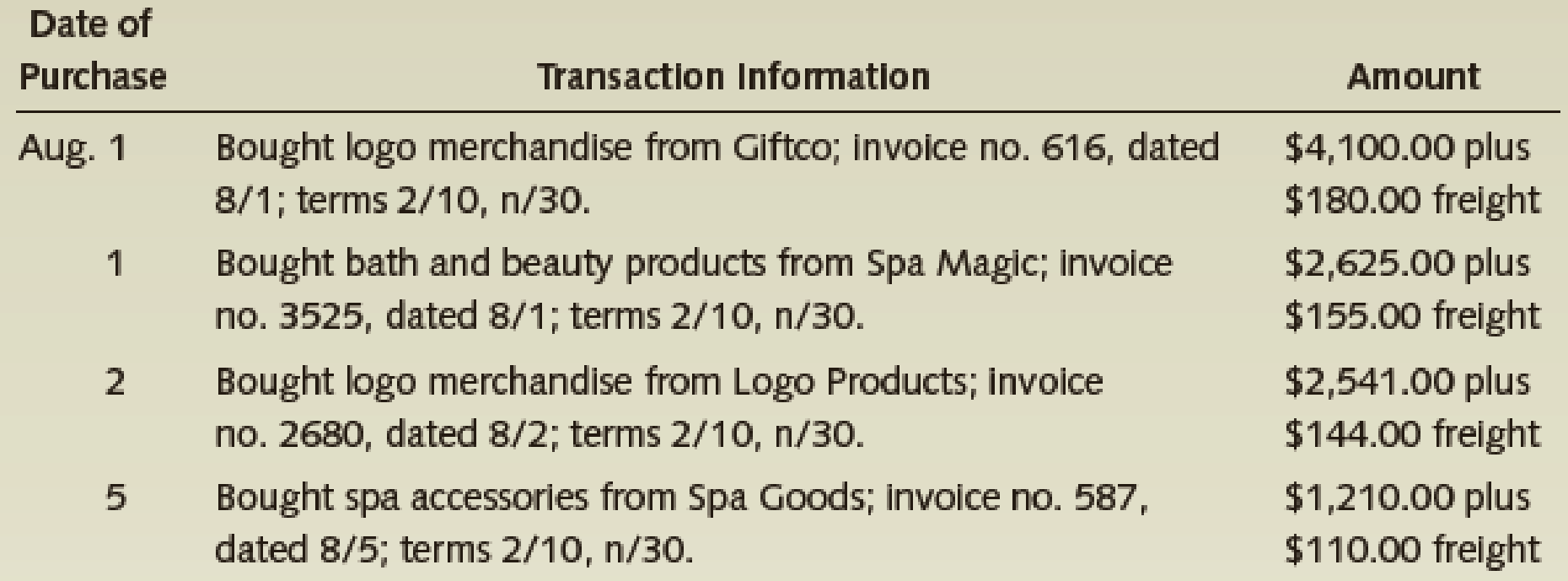

Terms 2/10, n/30 Purchases Freight In Accounts Payable Purchased merchandise from journal entries require twelve separate postings to general ledger accounts It takes a great deal of time and effort to post them 810 (5) Examples of Credit TermsReview the following transactions, and prepare any necessary journal entries for Renovation Goods On May 12, Renovation Goods purchases 750 square feet of flooring (Flooring Inventory) at $300 per square foot from a supplier, on credit Terms of the purchase are 2/10, n/30 from the invoice date of May 12For example the terms 2 10 n 30 means a 2 discount will be allowed if the payment is made within 10 days of the date of invoice otherwise the full amount is to be paid in 30 days Terms 2 10 n 30 journal entry If paid within 10 days of the invoice date the buyer may deduct 2 from the net amount What does 2 10 net 30 mean

Slides Show

Wild Financial Managerial 6e Ch04

2/10, n/30 If the vendor's invoice has terms of 2/10, n/30, the "2" represents 2%, the "10" represents 10 days, the "n" represents the word net and the "30" represents 30 days This means that the buyer can take an early payment discount of 2% of the amount owed if the amount is remitted within 10 days instead of the customary 30 daysThe following journal entry would be made in the books of Metro company to record the purchase of merchandise * Net of discount ($500 × 15) – $25 discount (2) On the same day, Metro company pays $3 for freight and $100 for insurance The following journal entry would be made to record the payment of freightin and insurance expenses (3)Jun 09, · 0103 Bazigha started with cash Rs 400,000, Building Rs 1,0,000, Furniture Rs 0,000, Van Rs 900,000 and Goods worth 300,000;

Special Journals Financial Accounting

Solved Chec Prepare Journal Entries To Record The Followi Chegg Com

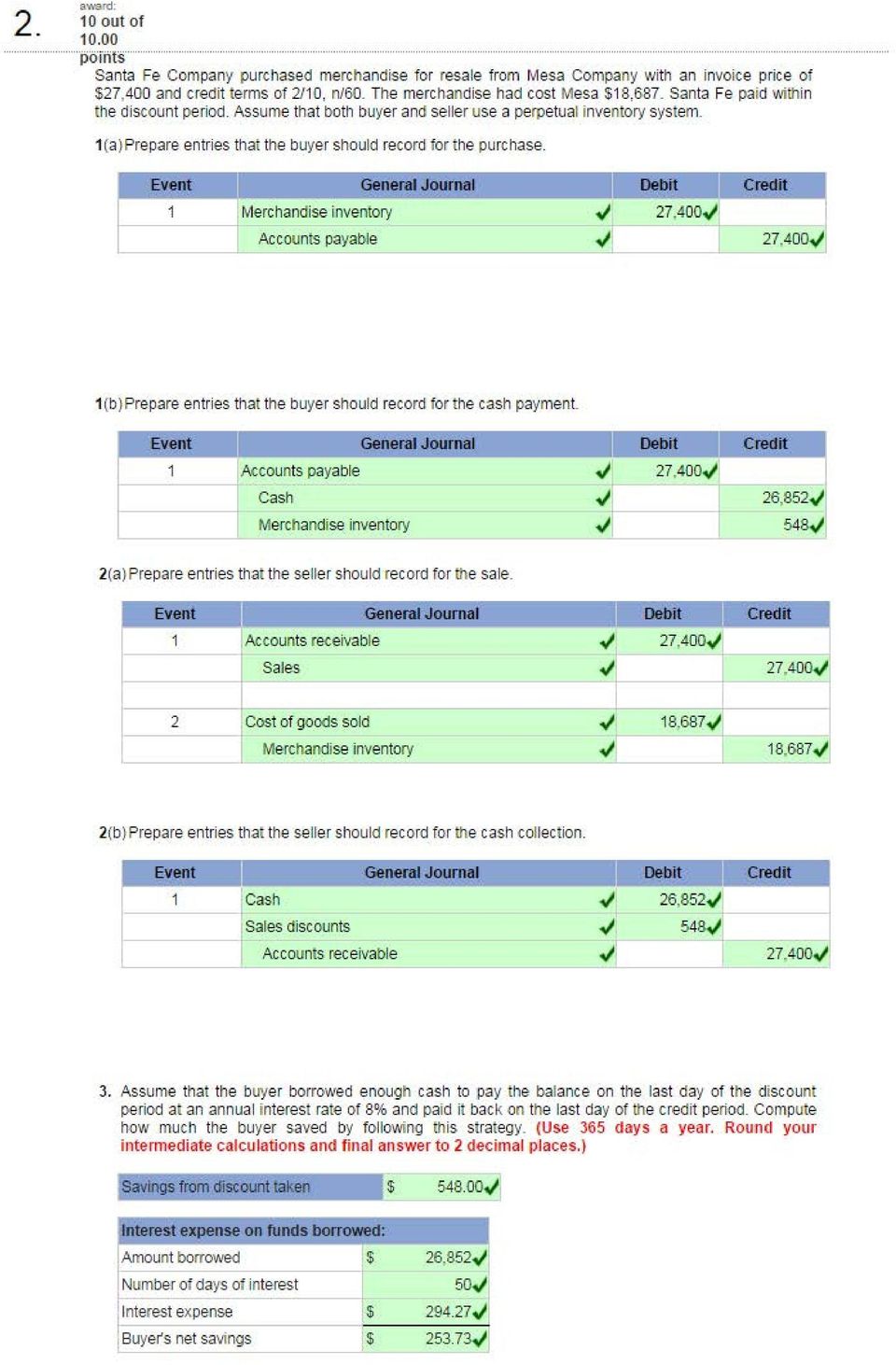

Doubleentry bookkeeping, in accounting, is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different accountThis lesson will cover how to create journal entries from business transactions Journal entries are the way we capture the activity of our businessFeb 09, 18 · Q1 The entity purchased new equipment and paid $150,000 in cash Prepare a journal entry to record this transaction Journal Entry DebitCredit Equipment 150,000 &nLearn to journalize buyer/seller entries using the gross, perpetual method Pay close attention to the differences and how the buyer and seller treat certain

Accounts Receivables

Accounts Payable Journal Entries Most Common Types Examples

Apr 30, · A compound journal entry could have as little as three accounts, or it could reach double digits (eg, payroll accounting entries) Unlike simple journal entries, which only deal with one debit and one credit, compound entries have two or more debits, credits, or bothJan 29, · Examples of common journals The precise journals you use for your bookkeeping will depend on what kind of business you run Broadly, they're split into two categories The general journal, and the special journals The general journal contains entries that don't fit into any of your special journals—such as income or expenses from interest It can also be the place you recordConsider the same example above – Company A selling goods to John on credit for $10,000, due on January 31, 18 However, let us consider the effect of the credit terms 2/10 net 30 on this purchase The journal entries would be as follows

Accounting For Merchandising Businesses Ppt Download

P04b The Accounting Process Merchandising Business Debits And Credits Business Economics

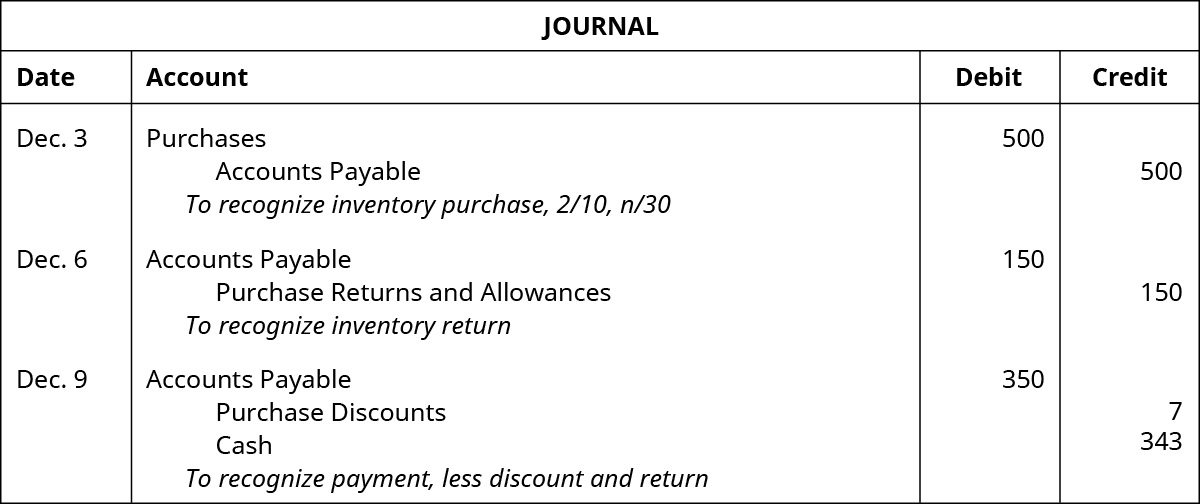

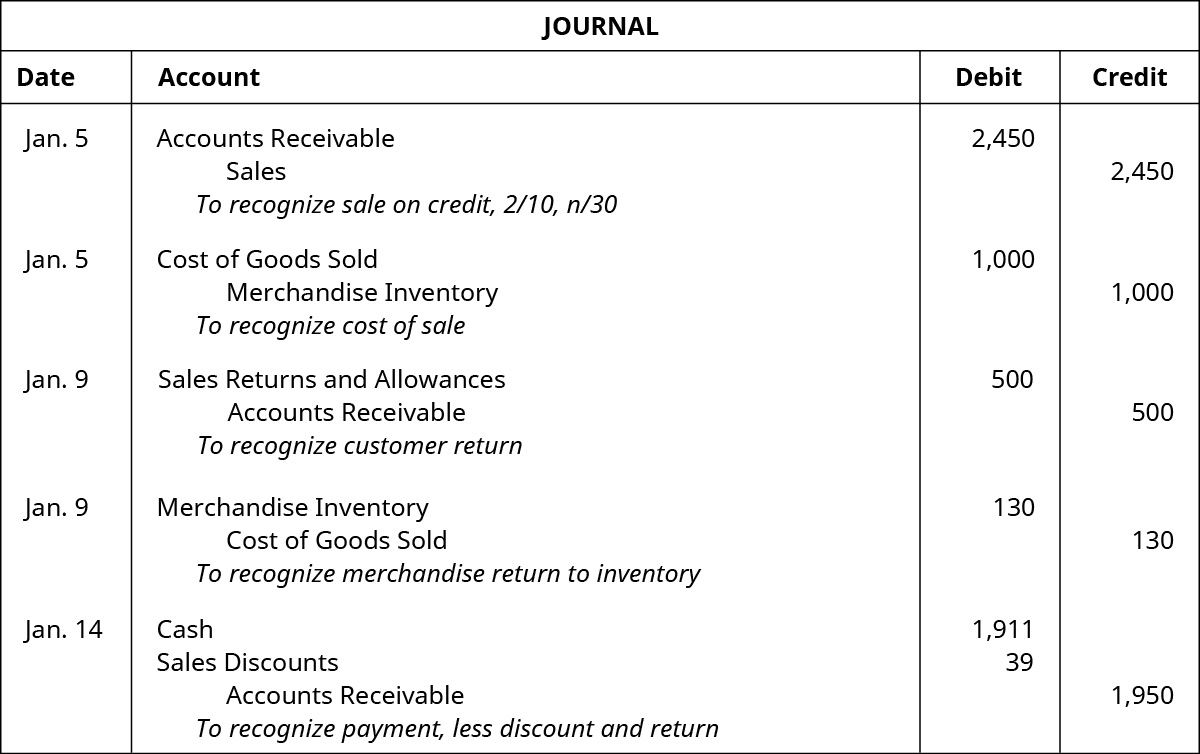

Purchase Discount Transaction Journal Entries On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit The payment terms are 5/10, n/30, and the invoice is dated May 1 The following entry occurs On May 10, CBS pays their account in full The following entry occursMerchandise is sold on account on January 16, terms 2/10, n/30, and recorded by debiting Accounts Receivable and crediting Sales for $2,000 If payment occurs on January 21, the journal entryMerchandise is sold on account January 16, terms 2/10, n/30, and recorded by debiting Accounts Receivable and crediting Sales for $2,000 If payment occurs on January 21, the journal entry

Sales Discounts

Purchases With Discount Net Principlesofaccounting Com

Noor & Co purchased merchandise inventory from Samsil on credit terms of 2/10, n/30 At the time of purchase, voucher number 449 was prepared for $ 70,000 payable to Samsil June 7 The company issued cheque number 303 to pay off voucher number 448 June 10Merchandise with a sales price of $5,000 is sold on account with terms 2/10, n/30 The journal entry to record the sale would include a

Treatment Of Cash Discounts Explanation Journal Entry And Example Play Accounting

Inventory Discounts Accounting In Focus

Illustrative Example Journal Entries For New Accounts

Acg21 Connect Ch 4

Explain The Revenue Recognition Principle And How It Relates To Current And Future Sales And Purchase Transactions

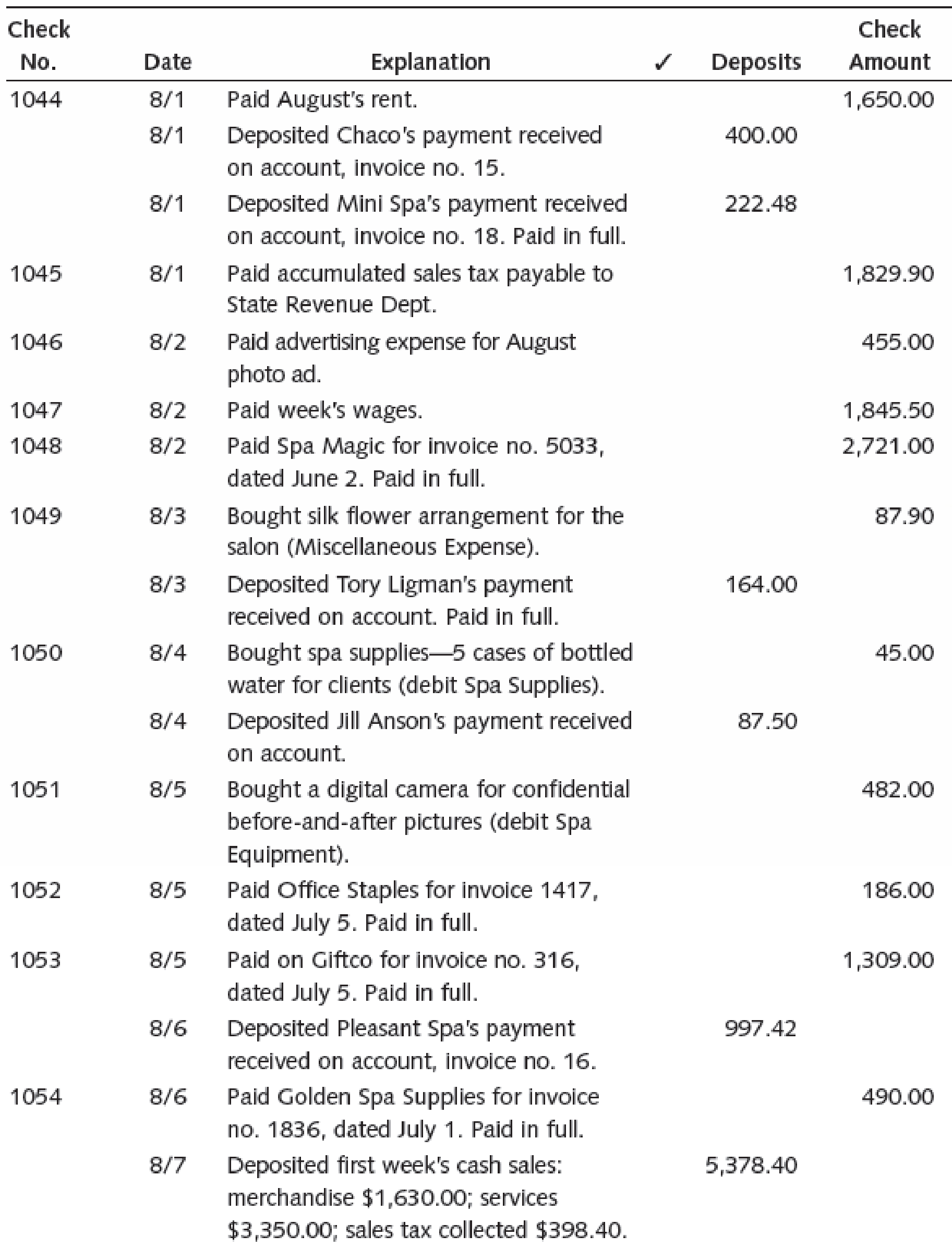

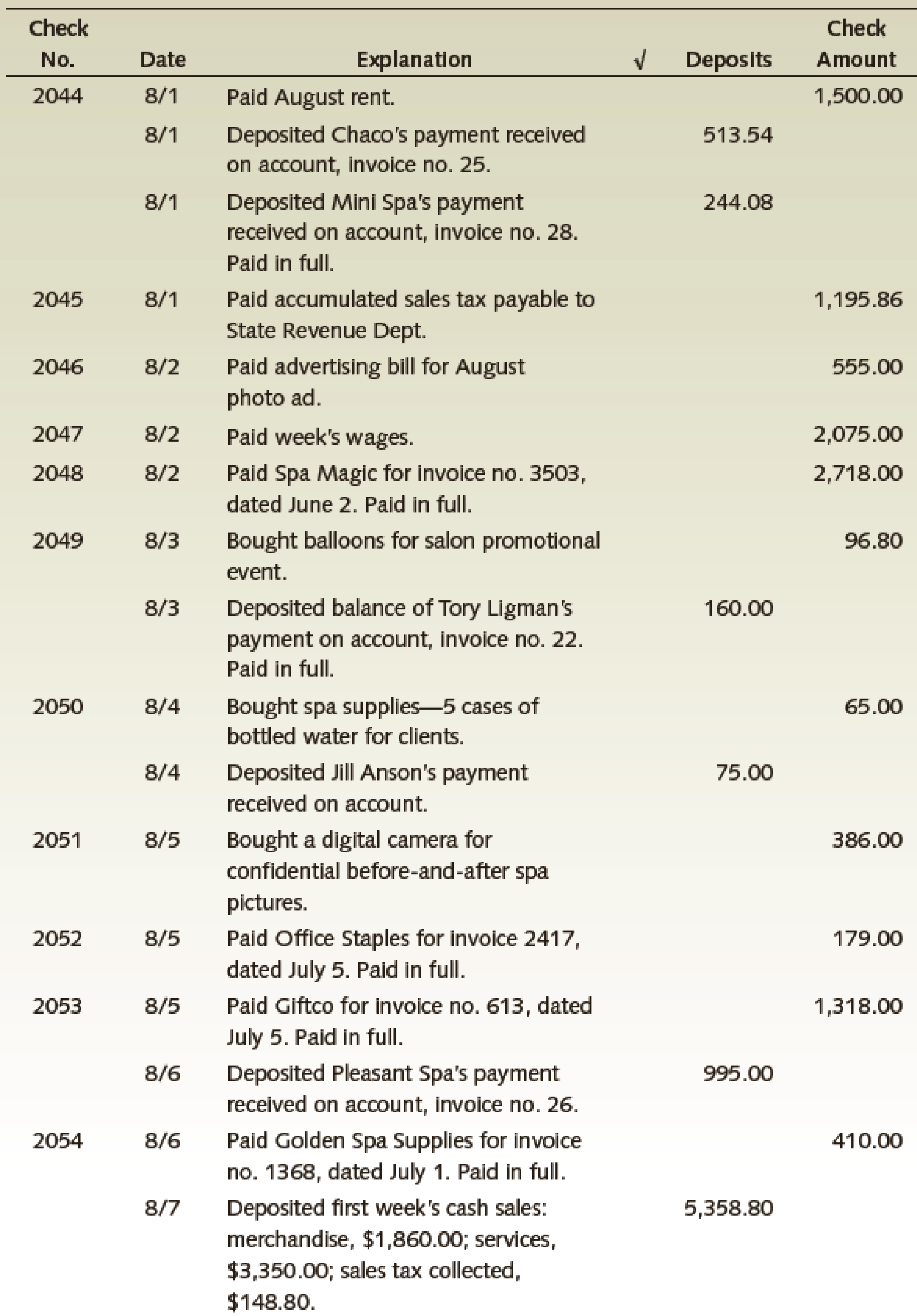

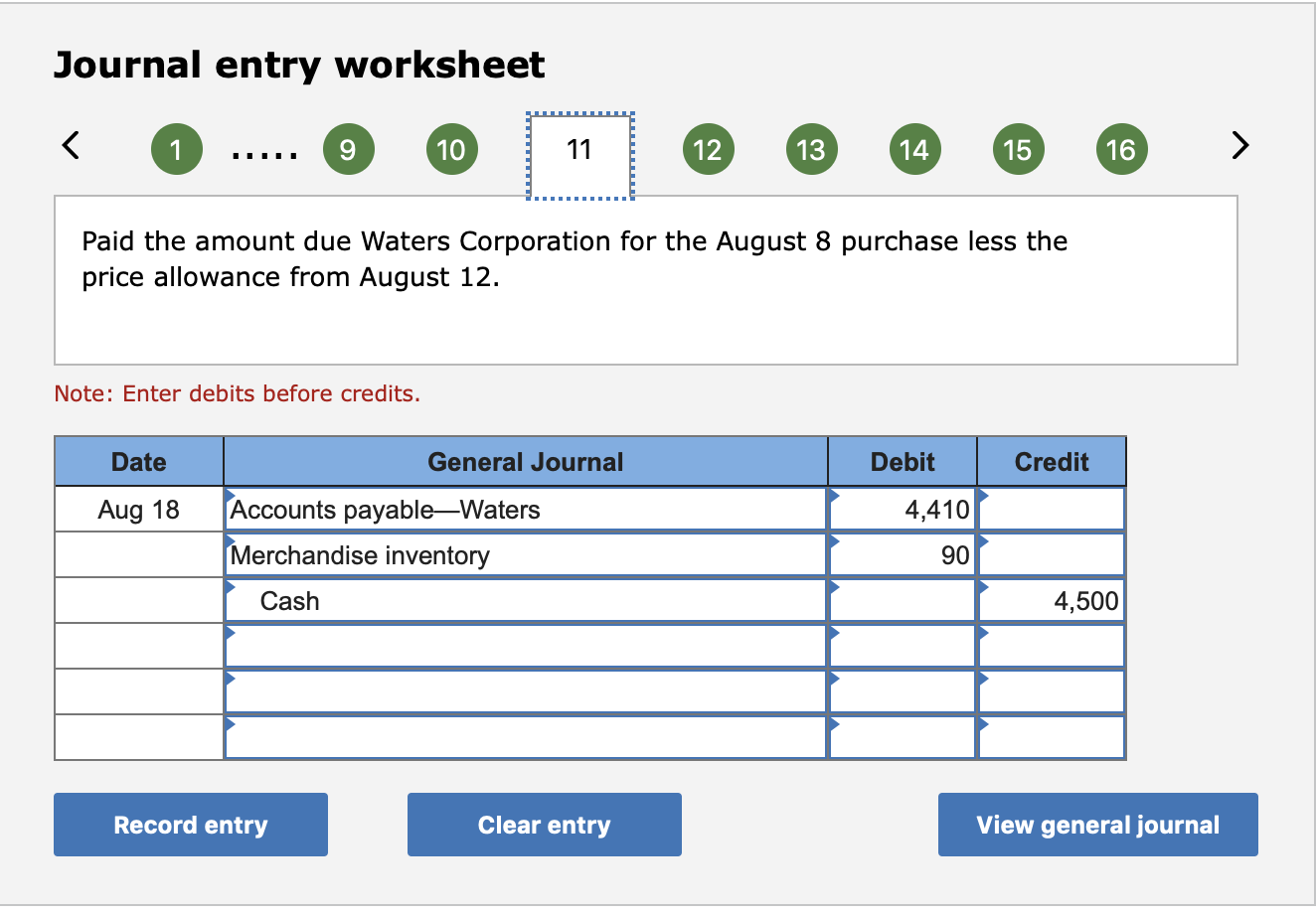

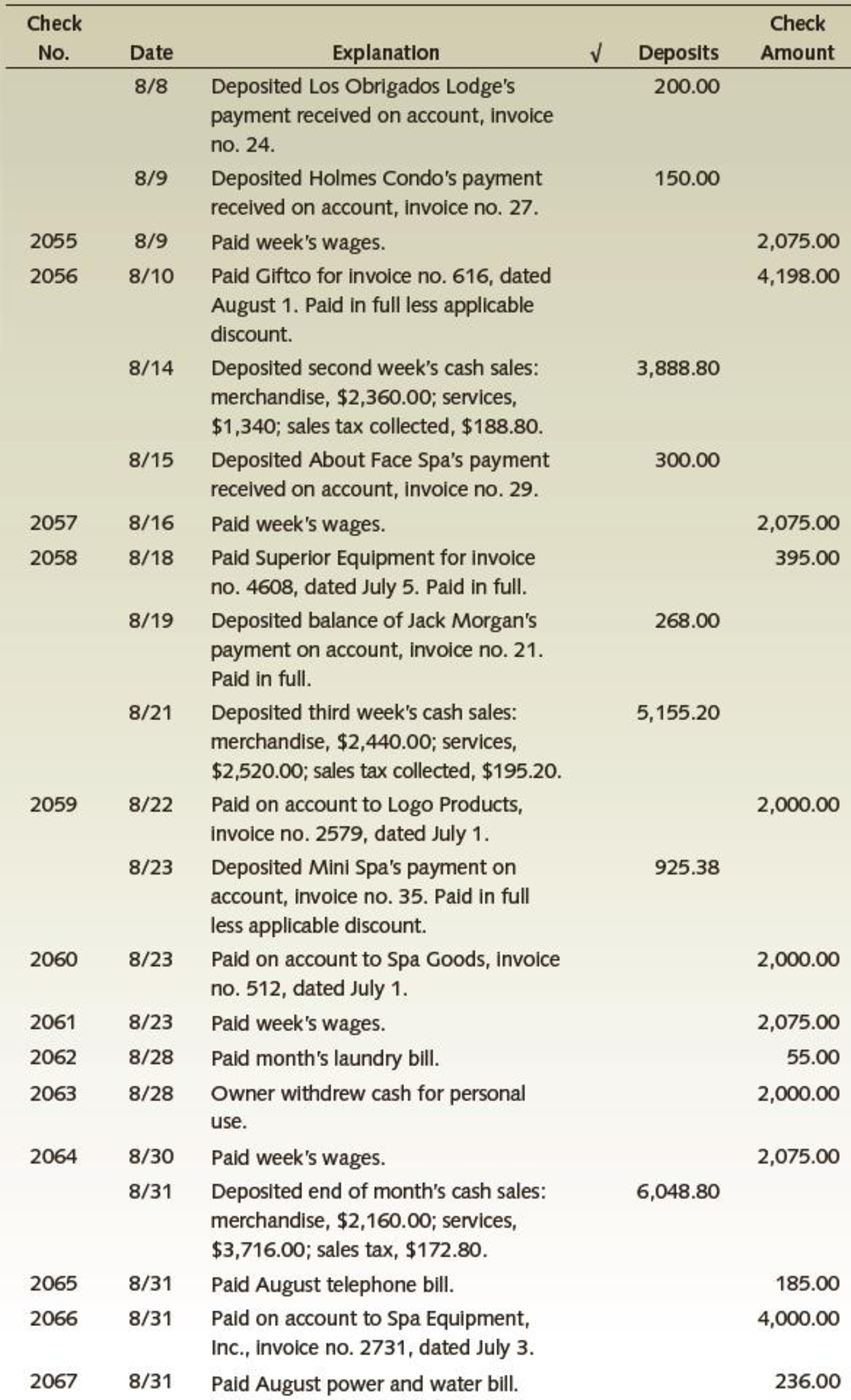

August Journal Entries Ms Valli Has Provided The Transactions For The Month Of August To Be Entered In The System All About You Spa Does Not Track Cash Sales By Customer If

Account For Purchase Of Inventory In A Perpetual System Youtube

The Merchandising Operation Sales Principlesofaccounting Com

2 10 Net 30 Meaning Examples Advantages Disadvantages

Explain The Revenue Recognition Principle And How It Relates To Current And Future Sales And Purchase Transactions

Sales On Credit And Credit Terms Accountingcoach

Solved Problem 5 3 A Journal Entries For Merchandising Activities Perpetual Lo Prepare General Journal Entries To Record The Following Perpetu Course Hero

Purchase Considerations For Merchandising Businesses Principlesofaccounting Com

Acct 1 Midterm Flashcards Quizlet

Solved Prepare Journal Entries To Record The Following Me Chegg Com

Accounting For Merchandising Activities Lecture Ppt Download

August Journal Entries Ms Valli Has Provided The Transactions For The Month Of August To Be Entered In The System All About You Spa Does Not Track Cash Sales By Customer Checkbook

How Does A Company Gather Information About Its Inventory

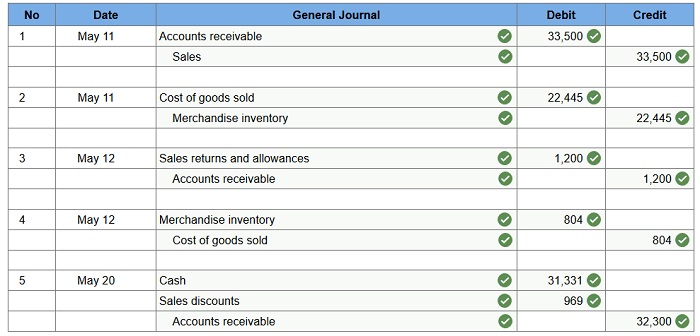

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Accounting For Merchandising Operations

What Do Credit Terms 2 10 Net 30 Mean Planergy Software

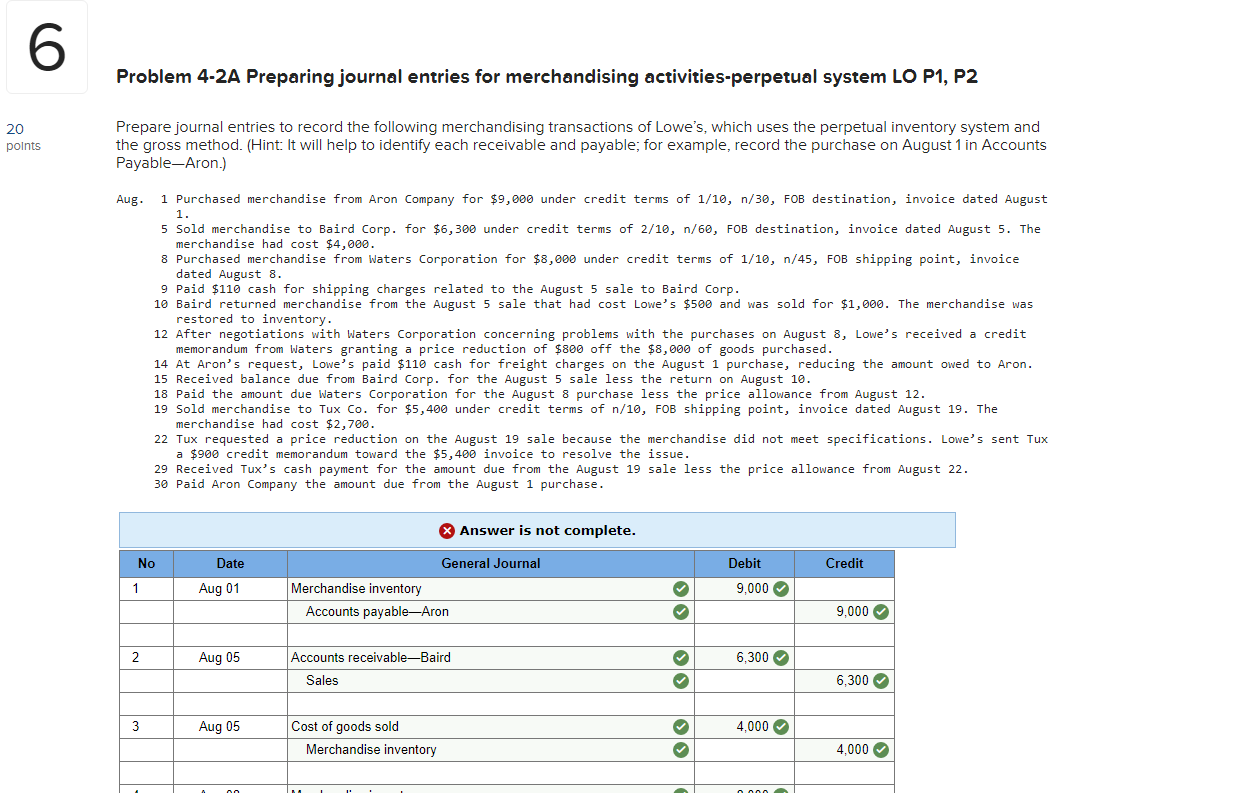

Solved 6 Problem 4 2a Preparing Journal Entries For Merch Chegg Com

Sales On Credit And Credit Terms Accountingcoach

Solved Prepare Journal Entries To Record The Following Me Chegg Com

August Journal Entries Ms Valli Has Provided The Transactions For The Month Of August To Be Entered In The System All About You Spa Does Not Track Cash Sales By Customer Checkbook

Solved Correct Way To Enter A Discount On A Vendor Bill

Inventory Discounts Accounting In Focus

Wild Financial Managerial 6e Ch04

2 10 Net 30 Understand How Trade Credits Work In Business

Merchandising Activities Prezentaciya Onlajn

Financial Accounting For Undergraduates 3 E Chapter 5

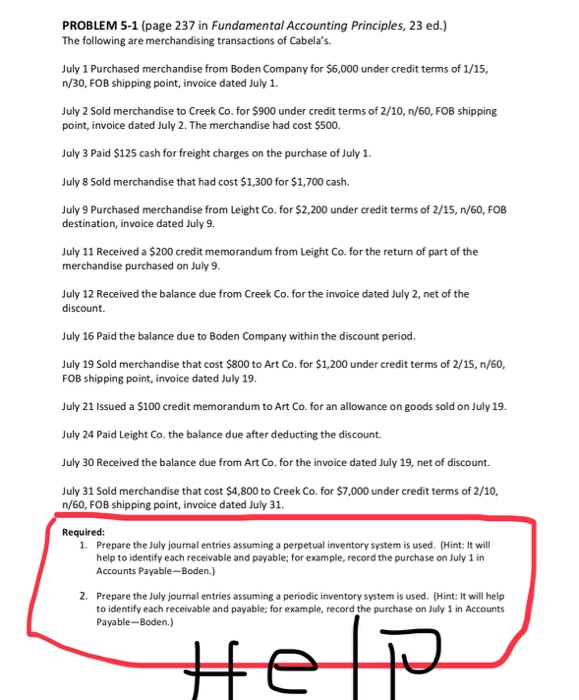

Exercise 5 Net Method Of Recording Purchases Accounting For Management

Points General Journal Debit Credit 10 Out Of Pdf Free Download

Fob Shipping Point Freight Prepaid Double Entry Bookkeeping

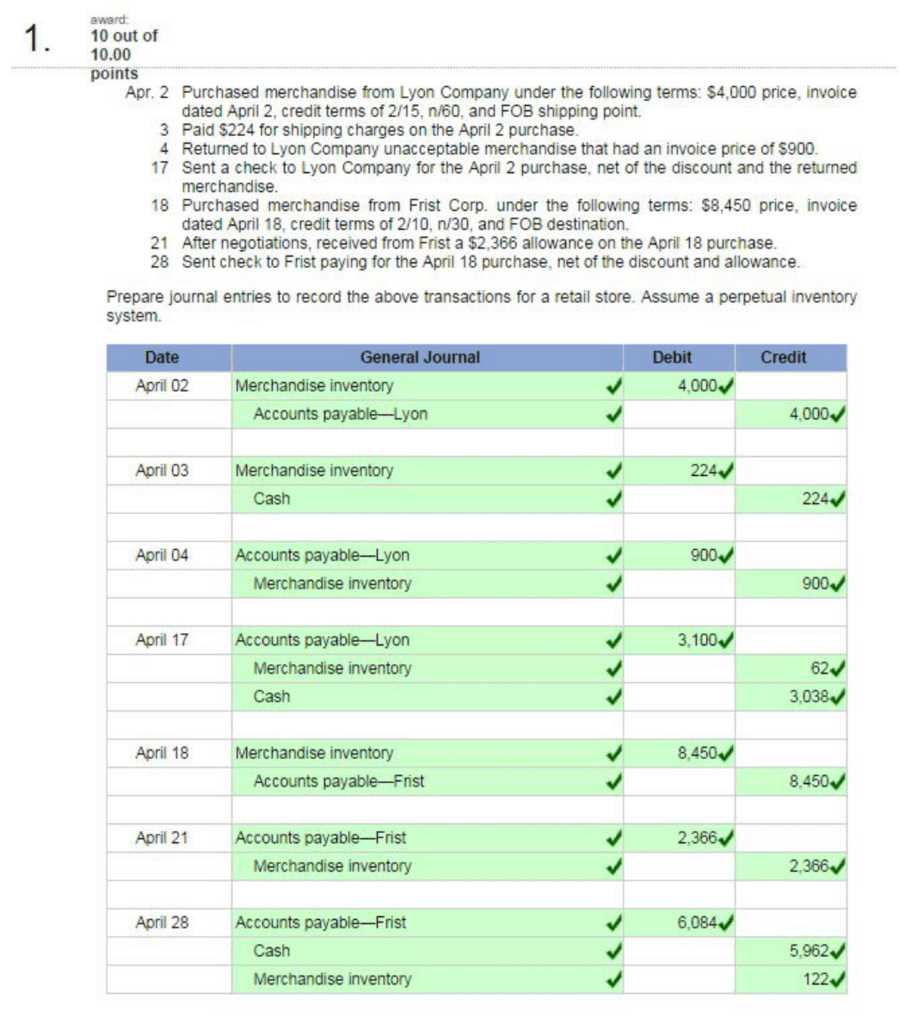

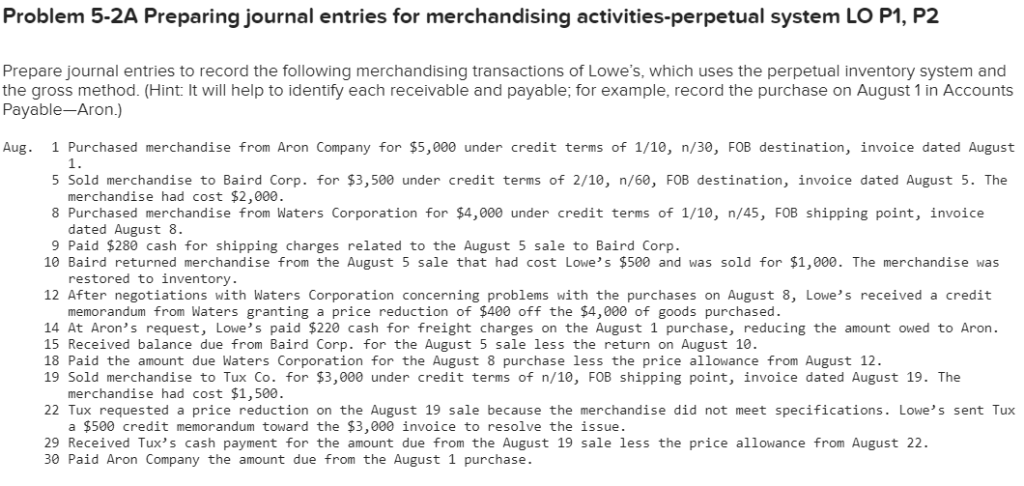

I Need Help Preparing A Journal Entry For The Merchandise Transactions If Lowe S Uses The Perpetual Homeworklib

Solved Need Help With The Requirements And How It S Done Chegg Com

Sales Returns Allowances Journal Entries Video Lesson Transcript Study Com

What Is The Net Method Definition Meaning Example

Revised Canvas Exercises For Merchandising Value Added Tax Accounts Payable

Purchase Considerations For Merchandising Businesses 5 2 Sp19 Acct 10 008

Acct 1 Exam 3 Flashcards Quizlet

Purchase Considerations For Merchandising Businesses Principlesofaccounting Com

Net Method Of Recording Purchase Discounts Play Accounting

Accounting For Merchandising Activities Lecture Ppt Download

Purchases Journal Definition Explanation Format Example Play Accounting

Internal Control Cash And Merchandise Sales Ppt Download

2 10 Net 30 Understand How Trade Credits Work In Business

Accounting For Receivables Financial Accounting Sixth Edition Ppt Video Online Download

2 10 Net 30 Invoice Payment Terms Explained Billbooks

Sales On Credit And Credit Terms Accountingcoach

Sales Journal Explanation Format Example Accounting For Management

Net Sales Accounting Video Clutch Prep

Acg21 Connect Ch 4

Connect Chapter 5 Homework Mgmt 026

Points General Journal Debit Credit 10 Out Of Pdf Free Download

What Is 2 10 N 30 Definition Meaning Example

Net 30 Terms Double Entry Bookkeeping

Solved Hi Please Help Prepare The Journal Entry To Reco Chegg Com

Early Payment Discount Reasons To Offer Accounting More

Ia2 02 Handout 1 5 Pdf Accounts Payable Discounting

Appendix Analyze And Record Transactions For Merchandise Purchases And Sales Using The Periodic Inventory System Principles Of Accounting Volume 1 Financial Accounting

2 10 Net 30 Meaning Examples Advantages Disadvantages

Solved Use The Provided Chart Of Account To Prepare The G Chegg Com

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Journal Entry For Cash Discount Play Accounting

What Is The Net Method Definition Meaning Example

Buyer Entries Under Perpetual Method Financial Accounting

Cost Of Goods Sold Journal Entries Video Lesson Transcript Study Com

Chapter5 Accounting For Merchandising Operations Recording Purchases Of

Understanding Early Payment Discounts On Invoices

Explain The Revenue Recognition Principle And How It Relates To Current And Future Sales And Purchase Transactions

2 10 Net 30 Definition Business Example Terms 2 10 N30 Meaning

2 10 Net 30 Understand How Trade Credits Work In Business

2 10 Net 30 Meaning Examples Advantages Disadvantages

Acg21 Connect Ch 4

Connect Financial Accounting Chapter 4 Ask Assignment Help

August Journal Entries Ms Valli Has Provided The Transactions For The Month Of August To Be Entered In The System All About You Spa Does Not Track Cash Sales By Customer Checkbook

0 件のコメント:

コメントを投稿